Please remember, investment value can go up or down and you could get back less than you invest. The value of international investments may be affected by currency fluctuations which might reduce their value in sterling.

Diversification is key to long-term investment success. By spreading your wealth across a broad range of investment types you reduce the risk of one poorly performing investment bringing your whole portfolio down.

Assets perform differently throughout the economic cycle and react to the stock market in different ways, so variety can give you more control of volatility in your portfolio and reduce overall risk. You should regularly review and rebalance your assets.

How to build a well-diversified portfolio

Most well-diversified portfolios should include the following asset classes: cash, fixed-interest and stocks and shares.

Cash

Savings accounts are low risk, in so far as you’ll always earn interest on your balance. However, over time its value is likely to be eroded by inflation, meaning you could lose money in real terms.

However, it’s still important to have some money in easy access accounts. As a starting point aim for three to six month’s expenses as a rainy-day fund. But you should also think about any major expenses you’ll have over the next few years including holidays, cars, house deposits or building work.

A good rule of thumb is if you’ll need the money within the next five years, keep it in cash.

Fixed-interest securities

These are loans that pay a fixed-rate of interest. Corporate bonds are loans to businesses while gilts or government bonds are loans to governments. It’s often helpful to think of fixed interest as a half-way house between cash and stocks and shares.

You can either buy individual bonds, or funds that offer access to a bond portfolio.

Stocks and shares

When you buy a share you’re buying a stake in a company. As such, the value of your holding will rise and fall with the performance of that business.

Shares are higher risk than fixed interest and cash, but they offer the greatest potential for growth. For this reason, it’s generally recommended that you only invest money into stocks and shares that you can tie up for at least five years. This will give your money time to ride out short-term volatility and benefit from compound returns.

You can buy shares in individual companies but it can be tricky (and expensive) to get the level of diversification you need.

It’s cheaper and easier to buy collective investments like funds, that invest in a portfolio of shares on your behalf.

Property

You might consider buying a rental property. However, a buy-to-let can be time consuming and costly to manage, with rising taxes making it increasingly difficult for amateur landlords to make money.

Commercial property, however, can be easier to access. Funds that buy properties including retail outlets, warehouses and entertainment venues, can pay a reliable income and be a great diversifier.

Commodities

These are investments in natural resources, for example metals, oils and agricultural products. The most common commodity for investors to turn to is gold as it holds its value well.

You can buy commodities directly, with a fund or by using an ETC (exchange-traded commodity) which enables you to buy exposure to a single commodity on the stock exchange.

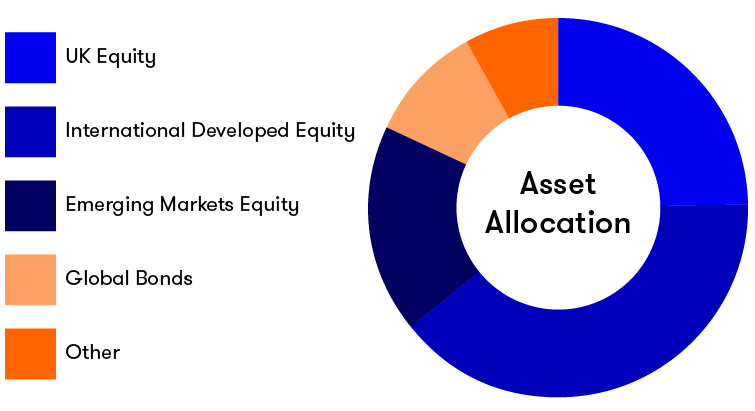

There’s no textbook asset allocation. What’s right for you will depend on factors including your need for cash and your attitude to risk.

The more money that is allocated to stocks and shares, the higher risk it will be. Normally, the longer you have until you need your money, the more risk you can take. You can always reduce the risk profile of your portfolio by altering your asset allocation over time.

How ii can help you choose investments

The idea of choosing your own investments can be daunting, but as long as you take it slowly it’s not as difficult as it sounds.

- Quick-start Funds are a good place to start. Chosen by our experts, they are invested across a wide range of markets and sectors, which can help to reduce risk. Many experienced investors trust these funds, too.

- You will receive impartial, expert intelligence so you can make better investment choices.

- Choose from multi-asset fund options – some of which can be found within ii’s Super 60.

- Explore our ready made portfolios including a broad mix of asset classes to give it the best chance of achieving investment goals

- More confident investors can choose from a huge range of shares, funds, investment trusts and ETFs.

Why investors choose us

- We're trusted by over 400,000 investors

- Rated 4.7/5 with 21,000+ reviews on Trustpilot

- More than 50% of our customers have been with us for more than 10 years

- 1 in 5 UK share trades are executed on the ii platform

- Our average hold time with our customer service team is under a minute