U.K.’s Latest Inflation Shock Adds to Pressure on Sunak to Act

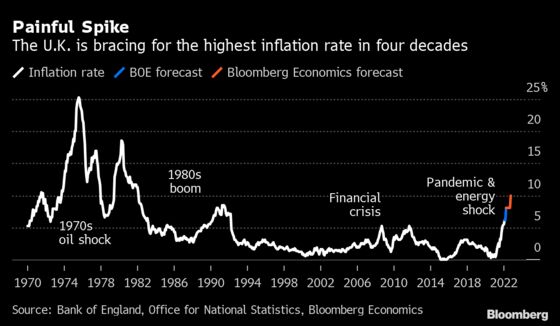

U.K. Inflation Rises More Than Expected to a New 30-Year High

(Bloomberg) --

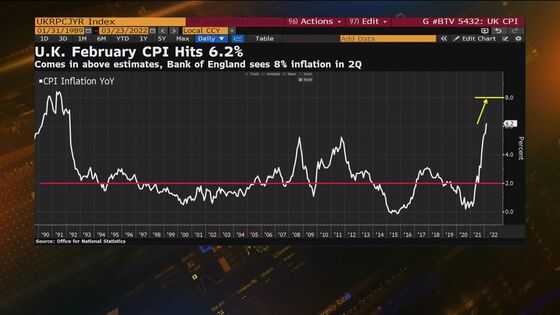

Britain’s inflation rate surged to a new 30-year high of 6.2%, adding to pressure on Chancellor of the Exchequer Rishi Sunak to protect consumers from a tightening squeeze on living standards.

Hours before Sunak is due to add to the 21 billion pounds ($28 billion) he’s already set out to cushion households from a surge in costs, the Office for National Statistics released figures showing price increases are broadening out across much of the U.K. economy.

The surge in prices has exceeded the forecasts of the Bank of England and Treasury, fanning concerns that shortages of workers following the end of the pandemic, along with the war in Ukraine, will lead to inflation spiraling further upward.

“The chancellor will need to set out a bold response to this cost of living crisis,” said Jack Leslie, senior economist at the Resolution Foundation. “Another sharp rise in inflation offers a foretaste of the huge income squeeze coming this year.”

Treasury officials have identified inflation as the biggest threat to the U.K. economy. Sunak speaks to Parliament at 12:30 p.m. on Wednesday, and his office said he’ll promise “security for working families as we help with the cost of living.”

The Chancellor is trying to juggle competing demands. He’s under intense political pressure from his own Conservative Party as well as the Labour opposition to tackle the snowballing cost-of-living crisis while delivering on pledges to cut taxes by 2024, and to get to grips with the record debt pile built up during the coronavirus pandemic.

The inflation figures are fanning speculation that the Bank of England will drive up interest rates more in the coming months, further tightening budgets for millions of households.

Money markets continue to bet on about a 30% chance of a half-point hike from the BOE in May and wager the key rate, now at 0.75%, will hit 2% by the end of this year. The yield on the U.K. 10-year bond fell 1 basis point to 1.69%, snapping a two-day advance.

What Bloomberg Economics Says ...

“The soaring cost of energy bills will drive the annual rate above 8% in April, probably pushing the central bank to act in May. We then expect a pause in the rate hiking cycle in 2H as high energy costs hit spending power, dealing a blow to the economy. The risk to our forecast is that gas and electricity prices keep falling later this year, giving the BOE more scope to raise rates beyond May.”

--Dan Hanson, Bloomberg Economics. Click for the full REACT.

The chancellor’s plan is to target support at those households that are hit hardest by the squeeze. Public sector finance statistics on Tuesday showed the budget deficit running 26 billion pounds ($34 billion) below official forecasts for the first 11 months of the tax year, giving the Treasury some leeway to act.

Sunak’s most likely options for action include a cut to fuel duty, which would ease the pain at the pumps with petrol prices at records, and raising the threshold at which people start paying national insurance, a payroll tax that’s set to rise by 1.25 percentage points next month to pay for health and social care costs. Sunak has repeatedly pushed back against calls from the opposition and his own party to scrap that tax hike.

Inflation, which has surged from just 0.4% when the country was locked down for the coronavirus a year ago, has overshot forecasts in eight out of the past 10 months.

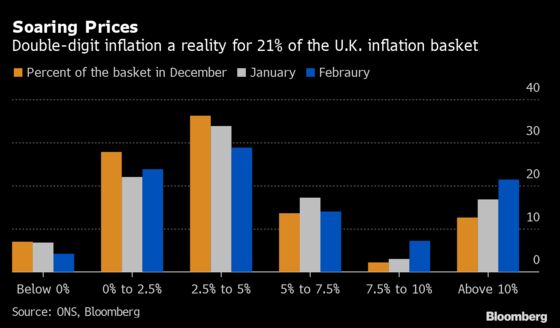

The index rose 0.8% in the month of February alone, the biggest increase since 2009. As in previous months, record fuel and energy costs were a big part of the increases. Gas, electricity and auto fuel posted some of the largest gains over the past year, rising by around a quarter on average. The price of second-hand cars surged more than 30%.

The figures also reflected broad-based gains, with 10 out of the 12 categories tracked by the ONS increasing in February.

- Recreation and culture had the biggest monthly gain in prices, with games, toys and hobbies increasing 2.5% between January and February

- Clothing and footwear prices rose 8.8% from a year ago

- Furniture, household equipment and maintenance rose 9.2%

- The cost of food and non-alcoholic drinks gained 5.1%

The report included a survey of consumers that will add to concern at the BOE that inflation is bedding into the economy. The ONS said 81% of the people polled in its Opinions and Lifestyle Survey reported an increase in their cost of living in the first half of March. Higher prices are being felt by four in every five Britons now.

Household behavior is responding. Asked what actions they were taking, half said they were spending less on non-essential items, 37% were using less gas and electricity at home, 37% were shopping around more and 30% were spending less on food and other essentials, the ONS lifestyle survey found.

While consumers are feeling a sharp squeeze on living standards, businesses are also being affected by soaring energy prices. In early February 2022, 16% of businesses reported their production or suppliers suffered from recent increases of wholesale gas prices.

A separate report into inflation at the factory gate showed:

- Producer input prices jumped 1.4%, taking the annual rate to 14.7%, which was close to the highest since records began in 1997

- Producer output prices grew 0.8% and were up 10.1% from a year earlier, the highest annual since 2008

“Rising inflation is now hardwired into routine business decisions, with price increases spread widely across all sectors of the economy,” said Kitty Ussher, chief economist at the Institute of Directors, which represents company executives.

The BOE is concerned that will lead to a broader increase in prices across the economy, potentially prompting workers to demand higher wages and fueling an inflationary spiral. Sunak and the Treasury are worried about the impact on the poorest households who already are having trouble affording their utility bills.

Next month, a price cap on domestic energy bills is set to rise 54%, piling further pressure on consumers. Sunak already unveiled a 9-billion pound package of measures in February to alleviate that, and officials have signaled he’s unlikely to do more in the near term.

Gas prices have surged over the past year with a reduction in supplies from Russia. The invasion of Ukraine raises the risk that those shipments are further limited, either by the government in Moscow or by sanctions imposed by western nations.

“Inflation will rise significantly over the next two months,” said Martin Beck, chief economic adviser to the EY ITEM Club. “Petrol prices have increased in recent weeks in reaction to the rise in oil prices. Inflation will then rise up again in April, as the 54% rise in the energy price cap takes effect, and the VAT rate for the hospitality sector returns to 20%.”

Read more:

©2022 Bloomberg L.P.