Alibaba’s Upscaled Buyback May Be a Sign of Things to Come

Alibaba’s Upscaled Buyback May Be a Sign of Things to Come

(Bloomberg) -- Alibaba Group Holding Ltd.’s $25 billion share buyback may kickstart a wave of such returns by cash-rich Chinese internet firms, giving investors a reason to revisit the battered sector.

Alibaba shares soared as much as 13% in New York Tuesday after the e-commerce giant ramped up its repurchase program, fueling rallies in the likes of Baidu Inc., JD.com Inc., Xiaomi Corp. and Tencent Holdings Ltd. on optimism that more Chinese technology giants will follow suit, and at scale.

“It is very likely that Tencent and Xiaomi will start share buybacks post results given their past practice,” said Willer Chen, an analyst at Forsyth Barr Asia Ltd. Companies listed on Hong Kong’s Hang Seng Tech Index bought back HK$2.5 billion ($319 million) worth of shares in January, led by Xiaomi, according to data compiled by Bloomberg.

Though buybacks are common practice among U.S. firms and have had a significantly positive impact on the S&P 500 for more than a decade, Chinese companies aren’t known for making sizeable repurchases. While Alibaba’s program is the largest in the region, it is still dwarfed by those of megacaps Apple Inc., Meta Platforms Inc. and Microsoft Corp. Apple expanded its repurchase program by $90 billion last year and has been buying back more than $20 billion worth of stock in each of its recent quarters.

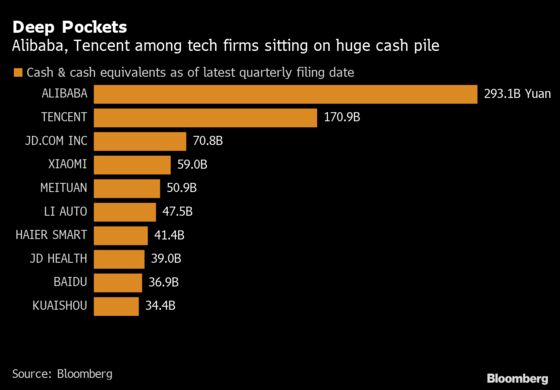

The Chinese firms aren’t short of funds. Alibaba had accumulated $46 billion in cash as of the latest quarter, Bloomberg data shows. Online gaming giant Tencent and e-commerce giant JD.Com also have tens of billions stashed, which could be used to start buybacks and boost the value of stocks that have nearly halved in value since their peak last February.

Chinese Tech Firms Ramp Up Share Buybacks in Bid to Halt Rout

While Tencent and Xiaomi have already bought back some shares in the market, adding to those purchases has potentially become more rewarding as investors refocus on valuations and earnings following Beijing’s vow to keep markets stable. Besides boosting confidence, reducing cash positions might be a wise move, since excessive liquidity would risk triggering concern about a company’s limited ability to utilize capital.

Tech Chart of the Day

Investors have been buying the dip in U.S. technology stocks, even as bond yields surge to the highest level in nearly three years. The Nasdaq 100 Index has bounced more than 10% since its March 14 low after entering a bear market, despite the hawkish turn in Federal Reserve policy. Tech companies can continue to generate robust or stable earnings and are less affected by higher commodity prices, even if broader economic growth will be slower going forward, according to State Street Global Markets strategist Marija Veitmane, who has a preference for U.S. tech stocks.

Top Tech Stories

- Shares in CD Projekt surged as Poland’s biggest video-game maker switched to Epic Games’s technology for the development of the next phase of its popular medieval series The Witcher

- Sony said it’s buying Montreal-based video-game development studio Haven Entertainment Studios Inc., led by industry veteran Jade Raymond

- Xiaomi posted a quarterly profit that beat analysts’ estimates after the Chinese smartphone giant defied component shortages to boost sales during the busy holiday season

- The hacking group Lapsus$ claims it gained internal access to the system privileges of Okta, the San Francisco-based company that manages user authentication services for thousands of companies

©2022 Bloomberg L.P.