Ford Breaks Green Bond Record With $2.5 Billion Debut Sale

Ford Debuts Green Bonds as Automaker Shifts to Electric Cars

(Bloomberg) -- Ford Motor Co. sold $2.5 billion of bonds whose proceeds are aimed at benefiting the environment, the automaker’s first as it transitions to making electric vehicles and the largest ever such offering from a U.S. corporation.

The Dearborn, Michigan-based company priced green bonds expected to mature in 10 years, according to a person with knowledge of the matter. The security yields 3.25%, after early pricing discussions in the 3.625% area, and net proceeds will be used exclusively for clean transportation projects and for the design, development and manufacturing of its battery electric-vehicle portfolio, the person said.

Ford said last week that it plans to sell at least $1 billion of green bonds, as part of a broader plan to cut its borrowing costs by more than half through repurchasing $5 billion of junk-rated debt and trying to return to investment-grade credit ratings.

“This lowers the cost of our debt substantially,” John Lawler, chief financial officer, said in an interview last week, when the company disclosed its repurchase plans. “It provides us additional financial flexibility, not only from the standpoint of lower interest expense, but also it’s strengthening the balance sheet, which is good as we work to return to investment grade.”

Companies globally are under pressure from consumers, investors and regulators to cut carbon emissions and are tapping the fast-expanding world of environmental, social and governance debt to fund the transition. Toyota Motor Corp. found at a structured finance conference that investors asked about ESG issues in about two-thirds of the company’s meetings without being prompted, Adam Stam, director of capital markets at Toyota Motor Credit Corp., said last year.

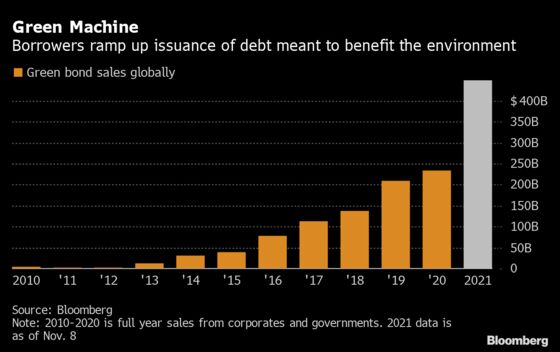

Global sales of green bonds are at more than $447 billion so far this year, a record level and nearly double the $234 billion raised in the whole of 2020. Ford’s sale is the largest green bond offered by a U.S. corporation, according to data compiled by Bloomberg.

Ford aims to become carbon neutral no later than 2050 and a significant portion of the funds raised through its sustainable finance strategy will go toward expanding electric vehicle technology and charging infrastructure, and improving the customer experience.

“We’re again putting our money where our mouth is, prioritizing and allocating capital to environmental and social initiatives that are good for people, good for the planet, and good for Ford,” Lawler said in a statement last week.

Barclays Plc, BNP Paribas SA, Bank of America Corp., Credit Agricole SA, Mizuho Financial Group Inc., Morgan Stanley and Royal Bank of Canada managed the bond sale.

“It is a strong example of a legitimate green bond,” James Rich, a senior portfolio manager at Aegon Asset Management, said via email. “It passes our proprietary labeled bond assessment process with their focus on zero-emission vehicles and associated infrastructure, and is strongly aligned with long-term trends towards a sustainable global economy.”

Ford has enough liquidity to fund its plans to reposition its main business, CreditSights analysts led by Brian Studioso wrote in a report Monday. And its bonds are still attractive for investors looking for more yield, even if it might take time for the company to return to investment grade, the strategists said. The research firm said it expects strong demand for the Ford bonds.

Read more: Yield-Hungry Pension, High-Grade Funds Become Junk-Bond Force

Bloomberg Intelligence credit analyst Joel Levington sees Ford having the potential to save hundreds of millions of dollars in cash interest expense by using excess cash to buy back debt.

Fitch Ratings assigned a BB+ rating to Ford’s proposed green bonds and expects Ford’s leverage to remain elevated for the next couple years compared with pre-pandemic levels, even with the planned debt buybacks.

©2021 Bloomberg L.P.