As Congress weighs lending help to some publicly traded companies, critics want those corporations to be banned from ever conducting stock buybacks again.

So exactly what is a stock buyback and why all the fuss?

Here's the deal: First, when a corporation buys back its stock, the move reduces the number of shares that trade publicly.

"The company either buys them on the open market or directly makes an offer to shareholders," explained certified financial planner Douglas Boneparth, president of Bone Fide Wealth in New York.

The upshot is that the buyback can push the per-share price higher, because some common metrics used to evaluate a stock price are spread across fewer shares, making the stock look more attractive.

"The company has the same earnings but fewer shares outstanding," Boneparth said.

Stock buybacks have been a common practice over the last several years, with companies looking to return value to shareholders in ways other than paying dividends.

However, critics contend that not only does it synthetically push the per-share price higher, the move benefits corporate executives, whose fortunes are often tied to stock ownership in their company.

U.S. airlines — whose revenues have nosedived in the midst of the coronavirus pandemic — are seeking at least $50 billion in federal aid to help them weather the disruption in their business. Some lawmakers want any aid provided to corporate America to ban those companies from future stock buybacks.

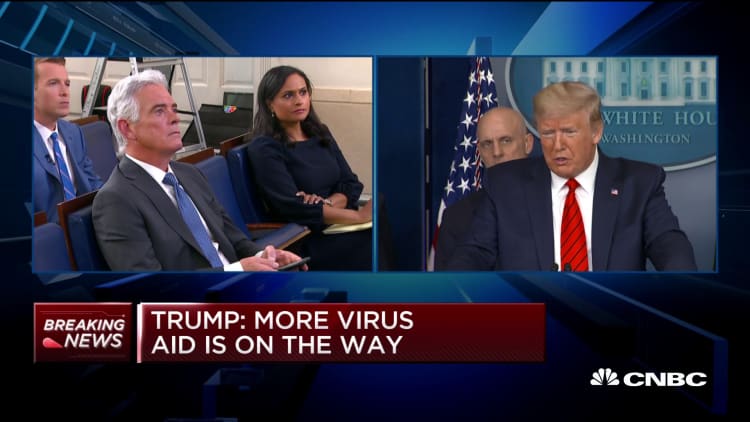

President Trump told CNBC on Thursday that he would not oppose such a ban, and reiterated that position on Friday during a coronavirus briefing.

More from Personal Finance:

Lawmakers push to extend tax filing season to July 15

How a cash infusion would help millions of Americans

67 million Americans may struggle to pay credit card bills